October of 2016, The Central Bank of Belize first implemented the Automated Payments and Securities Settlement System (APSSS) to expedite the clearing time for check deposits. Three years since the system’s introduction, Central Bank will commence charging financial institutions a fee for the processing of transactions through APSSS, effective Monday, July 1st. In turn, local banks will be charging customers fees for services rendered.

“Since its introduction, this modern national payment system has enhanced the safety, reliability, and efficiency of the financial system’s payment infrastructure. With financial institutions connected in a local network, banks have been able to provide a wider range of payment options and services to their customers, and these customers have been able to perform electronic payments anywhere in Belize,” said the Central Bank in a press release issued on Friday, June 7th. “The Central Bank foresaw the tremendous positive impact that APSSS would have for all Belizeans, and have shouldered the cost to acquire, implement, and maintain the system for the past three years. Financial institutions are now being asked to contribute minimal fees for the processing of transactions through APSSS.”

Through APSSS, financial institutions are connected to a local network, which enables banks to provide customers with services to make electronic payments quickly, safely, and securely anywhere in Belize. This project provides a wider range of payment options such as (1) Electronic Funds Transfer (EFT) for low-value payments (which includes bulk payments, such as payroll and accounts payable) within the same day, (2) Instant Funds Transfer (IFT) (an electronic payment that is available 24/7) within a few minutes, (3) Real-Time Gross Settlement (RTGS) for high value payments within an hour, and now (4) automated clearing and processing of cheques by the end of the next day.

The fees being charged by Central Bank to financial institutions using the service are as follows: $3.50 per transaction for Electronic Funds Transfer over $50,000 or time critical transactions of any value, $0.25 per transaction for Electronic Funds Transfer under $50,000, $0.50 per payment for Instant Funds Transfer, $1 per check for processing of checks up to $50,000, $50 per check for processing of checks $50,000 to $100,000 and $100 per cheque for processing of cheques above $100,000. “These fees will be used to offset the costs associated with maintaining and upgrading the system so that the Belizean people can continue to enjoy a modern and secure financial system. Furthermore, the fee structure was strategically designed to encourage the usage of the more efficient payment instruments,” says Central Bank.

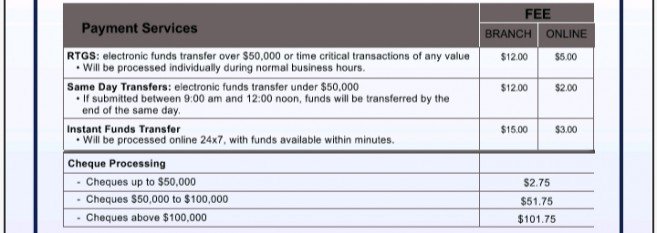

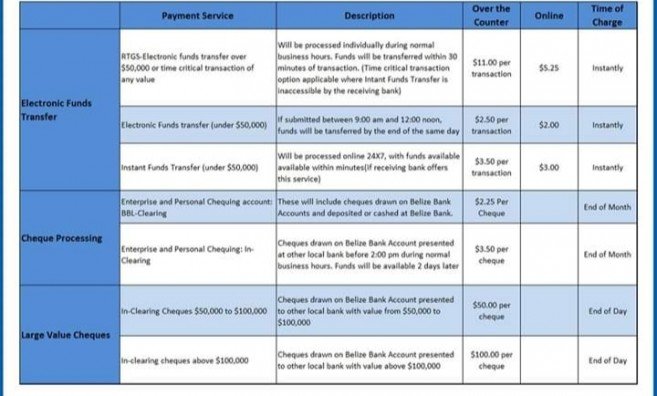

As a result of the fees implemented by Central Bank, banks have adjusted their service fees for the customer as well. In a public notice, Atlantic Bank announced their fee charges. “RTGS and Instant Fund Transfer fees remain the same; while, the Same Day Transfer fee has decreased from $3 to $2. Checks that you issue and are deposited at another bank will now incur an in-clearing check fee. On the last day of the month, your checking account will be charged for all checks that were sent to the APSSS system to clear,” indicated the Atlantic Bank notice. The San Pedro Sun has obtained the new charges for both Atlantic Bank and Belize Bank, as seen in the graphic below.

All residents are encouraged to visit their local banks to familiarize themselves with the new fees if any. For more information on the APSSS system visit www.centralbank.org.bz